Introduction

In today’s fast-paced, consumer-driven world, the concepts of cost vs value are often used interchangeably, yet they represent fundamentally different ideas. While cost refers to the monetary price paid for a product or service, value encompasses the benefits, satisfaction, and long-term impact derived from it. Understanding the distinction between the two is crucial for making informed financial decisions—whether in business, personal finance, or everyday life.

Defining Cost and Value

What Is Cost?

Cost is the explicit monetary amount required to purchase a good or service. It is objective, measurable, and often the first factor people consider before making a purchase. Costs can be:

-

Fixed (unchanging, like a subscription fee)

-

Variable (fluctuating, like utility bills)

-

Opportunity Cost (what you give up when choosing one option over another)

For example, a smartphone might cost $1,000 upfront—this is its price tag. However, cost alone doesn’t reveal whether the purchase is justified.

What Is Value?

Value, on the other hand, is subjective and depends on the perceived benefits a product or service provides. It includes:

-

Functional Value (how well it solves a problem)

-

Emotional Value (how it makes the user feel)

-

Long-Term Value (durability, ROI, or lifetime benefits)

Using the same smartphone example, its value could include:

-

High performance for work and entertainment

-

Long battery life saving time and hassle

-

A premium brand perception that enhances social status

A $1,000 phone may seem expensive, but if it lasts 5 years and improves productivity, its value exceeds its cost.

Why People Confuse Cost with Value

Many consumers (and even businesses) focus solely on minimizing cost rather than maximizing value, leading to poor decisions. Here’s why:

A. Short-Term Thinking

People often opt for cheaper alternatives to save money upfront, ignoring long-term costs. For example:

-

Buying a 50printer∗∗thatrequires∗∗30 ink cartridges monthly (high long-term cost)

-

Instead of a 300laserprinter∗∗with∗∗10 toner every 6 months (better value)

B. Misjudging Quality

Low-cost products may have hidden expenses like repairs, replacements, or inefficiency. A 10shirt∗∗that fades aftertwowashesofferslessvaluethana∗∗50 shirt lasting years.

C. Emotional Spending

Sometimes, people overpay for perceived value—like luxury brands charging premium prices for status rather than functionality.

When Cost Matters More Than Value

While value is often more important, there are cases where cost takes priority:

A. Limited Budget Constraints

If funds are tight, a person may prioritize affordability over long-term value (e.g., buying a used car instead of a new one).

B. Disposable or One-Time Use Items

For products with short lifespans (party decorations, basic tools), paying extra for durability may not be worth it.

C. Commodity Products

When products are nearly identical (like generic medicines), choosing the lowest cost option makes sense.

When Value Outweighs Cost

In many scenarios, paying more upfront leads to greater savings and satisfaction over time. Examples include:

A. High-Quality Tools and Equipment

-

A 1,000 laptop∗∗used for∗∗5+years∗∗forworkisbetterthana∗∗500 laptop replaced every 2 years.

-

Energy-efficient appliances cost more but save on electricity bills.

B. Education and Skill Development

A 5,000professionalcourse∗∗that boosts earning potential by∗∗20,000/year delivers massive value.

C. Health and Wellness

-

Organic food may cost more but reduces long-term health risks.

-

A $100/month gym membership preventing chronic diseases is more valuable than skipping it to save money.

D. Business Investments

-

Hiring skilled employees at higher salaries can increase productivity beyond labor costs.

-

Automation software with a 10,000/year∗∗subscriptionmaysave∗∗50,000 in manual labor.

How to Evaluate Cost vs. Value in Decision-Making

To make smarter choices, follow this step-by-step framework:

Identify the True Need

-

Are you buying for immediate necessity or long-term benefit?

Calculate Total Cost of Ownership (TCO)

-

Include maintenance, repairs, consumables, and resale value.

-

Example: Electric cars have higher upfront costs but lower fuel and maintenance expenses.

Assess Long-Term Benefits

-

Will this purchase save time, increase earnings, or improve quality of life?

Compare Alternatives

-

Use the Cost-Per-Use Formula:

Cost-Per-Use = Total Cost / Number of Uses

-

A 200jacketworn200times∗∗=∗∗1 per use (good value)

-

A 50jacketworn5times∗∗=∗∗10 per use (poor value)

-

Avoid Emotional Traps

-

Don’t overspend for brand prestige if functionality is the same.

Real-World Examples of Cost vs. Value

A. Apple Products: High Cost, High Value?

-

Cost: iPhones and MacBooks are more expensive than competitors.

-

Value: Long software support, premium build, and ecosystem integration justify the price for many users.

B. Toyota vs. Luxury Cars

-

A Toyota Camry (25,000)offers∗∗reliability and low maintenance∗∗,whilea∗∗BMW∗∗(50,000) provides prestige and performance—but at higher upkeep costs.

C. Fast Fashion vs. Sustainable Clothing

-

Shein offers $5 shirts but poor durability.

-

Patagonia charges $100 for a jacket but offers lifetime repairs and eco-friendly materials.

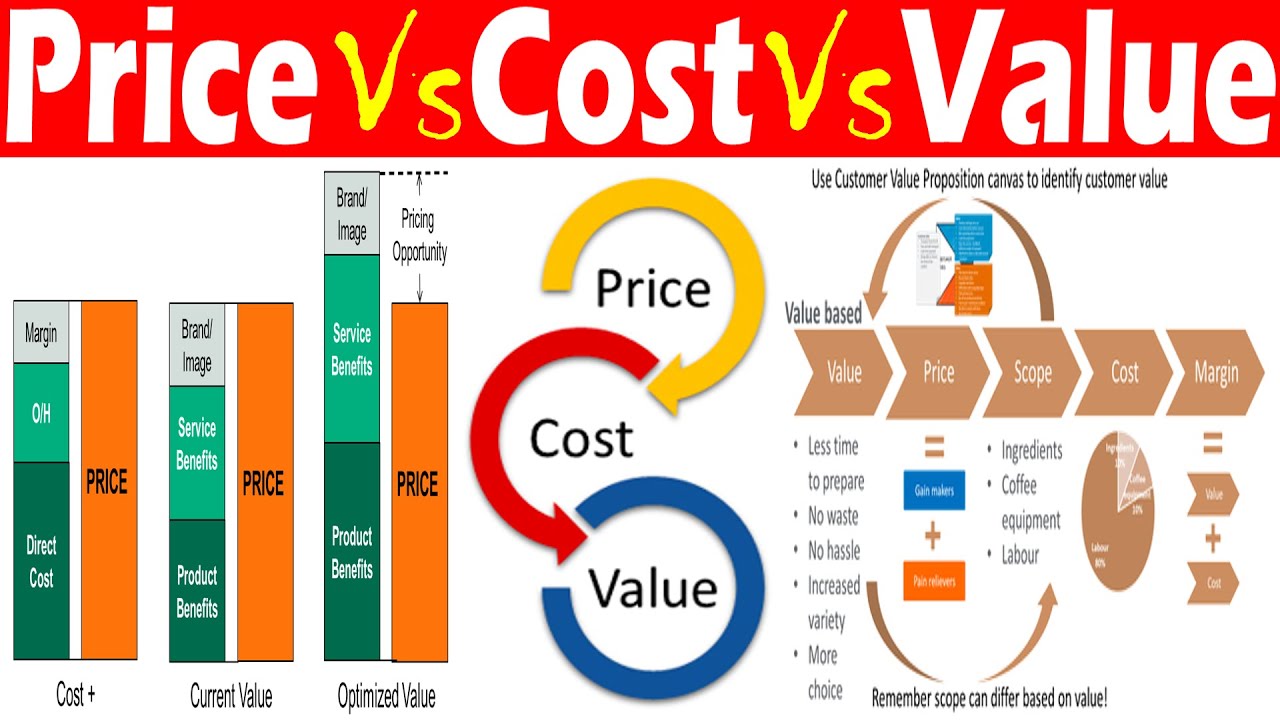

Business Perspective: Cost vs. Value Pricing

Companies use two main pricing strategies:

A. Cost-Based Pricing

-

Setting prices based on production costs + profit margin.

-

Common in commodity markets (e.g., milk, gasoline).

B. Value-Based Pricing

-

Pricing based on perceived customer value.

-

Examples:

-

Starbucks charges $5 for coffee because of the experience.

-

Tesla prices cars higher due to brand innovation.

-

Successful businesses focus on delivering value, allowing them to charge premium prices.

Conclusion:

The cost vs value debate isn’t about choosing one over the other—it’s about making informed decisions. Key takeaways:

✅ Cheapest isn’t always best—factor in long-term benefits.

✅ Most expensive isn’t always worth it—avoid overpaying for unnecessary features.

✅ Calculate Total Cost of Ownership (TCO) before purchasing.

✅ Align spending with personal or business goals—invest where value is highest.

By shifting focus from “How much does it cost?” to “What value does it provide?”, individuals and businesses can make smarter, more sustainable financial choices.